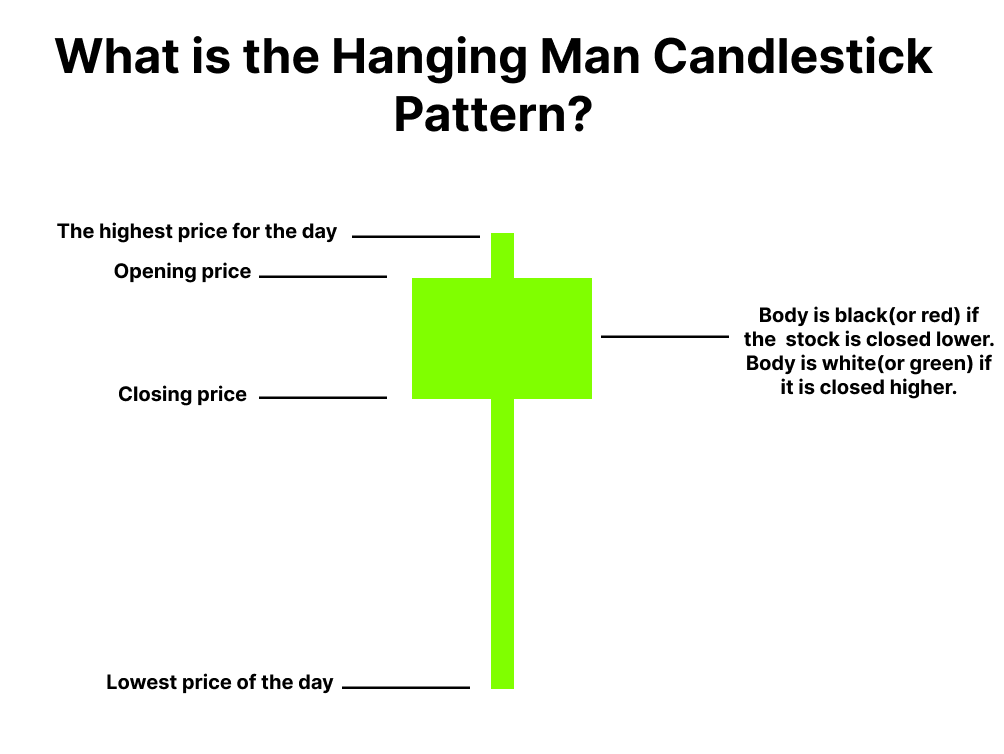

Hangman Doji Candlestick . in this guide to understanding the hanging man candlestick pattern, we’ll show you what this chart looks like, explain. It is a sign of weakness in the asset’s ability to sustain an uptrend. the hanging man candlestick, also known as the hanging man doji, is characterised by a single bearish candle with a small candle. the hanging man is a japanese candlestick pattern that technical traders use to identify a potential bearish reversal following a price rise. The candle is formed by a long lower. a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. the hanging man candlestick, an ominous signal in technical analysis, indicates a potential bearish market reversal. It forms during an upward trend and signals a potential reversal. This pattern, originating from traditional.

from www.5paisa.com

The candle is formed by a long lower. a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. the hanging man candlestick, an ominous signal in technical analysis, indicates a potential bearish market reversal. It forms during an upward trend and signals a potential reversal. in this guide to understanding the hanging man candlestick pattern, we’ll show you what this chart looks like, explain. It is a sign of weakness in the asset’s ability to sustain an uptrend. This pattern, originating from traditional. the hanging man is a japanese candlestick pattern that technical traders use to identify a potential bearish reversal following a price rise. the hanging man candlestick, also known as the hanging man doji, is characterised by a single bearish candle with a small candle.

What Is Hanging Man Pattern & How to Trade Using It Finschool

Hangman Doji Candlestick the hanging man candlestick, also known as the hanging man doji, is characterised by a single bearish candle with a small candle. the hanging man is a japanese candlestick pattern that technical traders use to identify a potential bearish reversal following a price rise. The candle is formed by a long lower. the hanging man candlestick, also known as the hanging man doji, is characterised by a single bearish candle with a small candle. It forms during an upward trend and signals a potential reversal. the hanging man candlestick, an ominous signal in technical analysis, indicates a potential bearish market reversal. It is a sign of weakness in the asset’s ability to sustain an uptrend. a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. This pattern, originating from traditional. in this guide to understanding the hanging man candlestick pattern, we’ll show you what this chart looks like, explain.

From learn.bybit.com

How to Use Hanging Man Candlestick Pattern to Trade Trend Reversal Hangman Doji Candlestick This pattern, originating from traditional. the hanging man is a japanese candlestick pattern that technical traders use to identify a potential bearish reversal following a price rise. the hanging man candlestick, also known as the hanging man doji, is characterised by a single bearish candle with a small candle. a hanging man is a bearish candlestick pattern. Hangman Doji Candlestick.

From www.youtube.com

Hanging Man Candlestick Patterns Complete guide [ AZ ] YouTube Hangman Doji Candlestick The candle is formed by a long lower. a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. the hanging man candlestick, an ominous signal in technical analysis, indicates a potential bearish market reversal. It is a sign of weakness in the asset’s ability to. Hangman Doji Candlestick.

From innercircletrading.website

Meaning of doji candlestick pattern in Forex Trading Hangman Doji Candlestick The candle is formed by a long lower. It is a sign of weakness in the asset’s ability to sustain an uptrend. This pattern, originating from traditional. a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. It forms during an upward trend and signals a. Hangman Doji Candlestick.

From www.youtube.com

A Beginner's Trading Guide to Inverted Hammer and Hanging Man Hangman Doji Candlestick The candle is formed by a long lower. the hanging man is a japanese candlestick pattern that technical traders use to identify a potential bearish reversal following a price rise. the hanging man candlestick, also known as the hanging man doji, is characterised by a single bearish candle with a small candle. This pattern, originating from traditional. It. Hangman Doji Candlestick.

From www.sexizpix.com

Doji Candlestick Types Sexiz Pix Hangman Doji Candlestick the hanging man candlestick, an ominous signal in technical analysis, indicates a potential bearish market reversal. the hanging man is a japanese candlestick pattern that technical traders use to identify a potential bearish reversal following a price rise. a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of. Hangman Doji Candlestick.

From telegra.ph

TipsHow to Trade Using the Doji Candlestick Pattern? Telegraph Hangman Doji Candlestick It is a sign of weakness in the asset’s ability to sustain an uptrend. the hanging man is a japanese candlestick pattern that technical traders use to identify a potential bearish reversal following a price rise. in this guide to understanding the hanging man candlestick pattern, we’ll show you what this chart looks like, explain. The candle is. Hangman Doji Candlestick.

From www.tradingview.com

Candlestick Patterns (Every Trader Should Know) Hangman Candle for Hangman Doji Candlestick This pattern, originating from traditional. in this guide to understanding the hanging man candlestick pattern, we’ll show you what this chart looks like, explain. It forms during an upward trend and signals a potential reversal. a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come.. Hangman Doji Candlestick.

From cartoondealer.com

Hammer With Hangman Price Action Of Candlestick Chart RoyaltyFree Hangman Doji Candlestick The candle is formed by a long lower. It is a sign of weakness in the asset’s ability to sustain an uptrend. It forms during an upward trend and signals a potential reversal. the hanging man candlestick, an ominous signal in technical analysis, indicates a potential bearish market reversal. in this guide to understanding the hanging man candlestick. Hangman Doji Candlestick.

From www.dailyfx.com

How to Trade Reversals with the Hanging Man Pattern Hangman Doji Candlestick a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. It forms during an upward trend and signals a potential reversal. the hanging man candlestick, an ominous signal in technical analysis, indicates a potential bearish market reversal. the hanging man candlestick, also known as. Hangman Doji Candlestick.

From fxopen.com

Understanding the LongLegged Doji Candlestick Pattern Market Pulse Hangman Doji Candlestick a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come. It forms during an upward trend and signals a potential reversal. in this guide to understanding the hanging man candlestick pattern, we’ll show you what this chart looks like, explain. It is a sign of. Hangman Doji Candlestick.

From www.wallstreetmojo.com

Doji Candlestick Pattern Meaning, Types, Examples, Charts Hangman Doji Candlestick the hanging man candlestick, also known as the hanging man doji, is characterised by a single bearish candle with a small candle. The candle is formed by a long lower. This pattern, originating from traditional. the hanging man candlestick, an ominous signal in technical analysis, indicates a potential bearish market reversal. It is a sign of weakness in. Hangman Doji Candlestick.

From www.5paisa.com

What Is Hanging Man Pattern & How to Trade Using It Finschool Hangman Doji Candlestick The candle is formed by a long lower. the hanging man candlestick, an ominous signal in technical analysis, indicates a potential bearish market reversal. in this guide to understanding the hanging man candlestick pattern, we’ll show you what this chart looks like, explain. It forms during an upward trend and signals a potential reversal. the hanging man. Hangman Doji Candlestick.

From exotrhfls.blob.core.windows.net

Candlestick Patterns Hanging Man at Queen Hanna blog Hangman Doji Candlestick It is a sign of weakness in the asset’s ability to sustain an uptrend. It forms during an upward trend and signals a potential reversal. the hanging man candlestick, also known as the hanging man doji, is characterised by a single bearish candle with a small candle. This pattern, originating from traditional. the hanging man candlestick, an ominous. Hangman Doji Candlestick.

From www.youtube.com

Hammer Hangman & Shooting Star Candlestick Candlestick Analysis Video Hangman Doji Candlestick the hanging man candlestick, also known as the hanging man doji, is characterised by a single bearish candle with a small candle. This pattern, originating from traditional. The candle is formed by a long lower. a hanging man is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come.. Hangman Doji Candlestick.

From www.youtube.com

Morning Doji Star and Morning Star Candlestick Pattern YouTube Hangman Doji Candlestick The candle is formed by a long lower. It is a sign of weakness in the asset’s ability to sustain an uptrend. the hanging man is a japanese candlestick pattern that technical traders use to identify a potential bearish reversal following a price rise. the hanging man candlestick, an ominous signal in technical analysis, indicates a potential bearish. Hangman Doji Candlestick.

From mavink.com

Hanging Man Doji Candlestick Pattern Hangman Doji Candlestick The candle is formed by a long lower. the hanging man candlestick, also known as the hanging man doji, is characterised by a single bearish candle with a small candle. the hanging man is a japanese candlestick pattern that technical traders use to identify a potential bearish reversal following a price rise. This pattern, originating from traditional. It. Hangman Doji Candlestick.

From cekinvestasi.com

Mengenal Doji Candle dan Tips Membacanya Cek Investasi Hangman Doji Candlestick This pattern, originating from traditional. the hanging man candlestick, also known as the hanging man doji, is characterised by a single bearish candle with a small candle. in this guide to understanding the hanging man candlestick pattern, we’ll show you what this chart looks like, explain. It is a sign of weakness in the asset’s ability to sustain. Hangman Doji Candlestick.

From bmoney.id

Doji Candlestick Pengertian, Jenis, Keuntungan, dan Cara Membacanya Hangman Doji Candlestick The candle is formed by a long lower. the hanging man candlestick, an ominous signal in technical analysis, indicates a potential bearish market reversal. the hanging man candlestick, also known as the hanging man doji, is characterised by a single bearish candle with a small candle. the hanging man is a japanese candlestick pattern that technical traders. Hangman Doji Candlestick.